Contactless has become the UK’s default way to pay, and regulators now expect every London taxi—and an increasing number of local authorities across the country—to offer card and contactless as standard. For travellers moving between airports, cruise ports, and cities, the shift removes friction (no cash runs, fewer disputes, faster drop-offs) and aligns cabs with the rest of the UK’s open-loop, tap-and-go transport ecosystem. The data show contactless is not just popular—it’s dominant. In April 2025 alone, there were 1.59 billion contactless transactions worth £25.8 billion, with contactless representing 76% of debit and 66% of credit card transactions.

Table of Contents

ToggleThe demand side: passengers tap first, ask questions later

Contactless is how Britain pays. UK Finance’s latest card-spending update shows another year of growth in both the number and value of contactless transactions, up 5.9% and 8.6% year-on-year, respectively (April 2025 vs April 2024). When three-quarters of debit-card purchases are contactless, passengers naturally expect cabs to accept taps just like supermarkets, train gates, and coffee shops.

Barclays’ consumer data tells the same story inside stores: 94.6% of all in-store card payments under £100 were contactless in 2024, up again on 2023. That behavioural norm spills straight into ground transport, where time pressure at the kerbside makes speed king.

Travel is going “open-loop”. Beyond cabs, national and city transport services continue to expand their “pay as you go” contactless options—no separate card or wallet required. In February 2025, pay-as-you-go contactless services were extended to 47 additional National Rail stations in the South East, further tightening the expectation that a single card or phone should work seamlessly throughout a journey. Payment networks are explicitly backing this seamlessness across public and private transport, arguing for a consistent, open-loop user experience.

Read Also – Is it easy to get a taxi at Gatwick Airport?

The supply side: why operators are turning card-only

For operators—especially those doing time-sensitive airport, cruise-port, and city transfers—card-only is a practical decision:

- Turnarounds and utilisation

Tap-to-pay ends the “ATM detour,” speeding pick-ups and drop-offs. For airports with strict kerbside rules and charges (e.g., Gatwick’s south and north terminal drop-off zones are card-only and must be paid by midnight the next day), eliminating cash handling saves minutes and avoids non-payment headaches. - Lower risk and admin

No cash means fewer theft concerns, fewer change disputes, and cleaner end-of-day reconciliations—significant for fleets serving late-night city transfers or early-morning airport runs. - Fewer payment failures under PSD2/SCA

While app-based card-on-file transactions can occasionally trigger strong customer authentication (SCA) challenges, contactless in-person taps are designed to be fast and SCA-friendly under the rules, reducing declines and friction at the kerb. - Receipts and reporting

Airport and corporate travellers need digital receipts for expenses and travel insurance claims. Card-only standardises e-receipts, reduces back-office calls, and simplifies HMRC-friendly record-keeping. - Customer expectation = better NPS

Travellers arriving from contactless-first markets (UK/EU) expect to tap. Meeting that expectation is now a table-stakes requirement for reviews and repeat business.

Read Also – Is it easy to get a taxi at Heathrow Airport?

The rulebook: how policy is locking in card acceptance

London taxis: Card and contactless payments have been mandatory since October 2016. Devices must be fixed in the passenger compartment. Drivers must provide printed receipts upon request. Additionally, surcharges for paying by card are not permitted. In 2025, TfL’s action plan goes further, signaling minimum connectivity standards and accessibility requirements for payment devices to ensure they work reliably and inclusively.

Beyond London: local authorities are moving in the same direction. In Southampton—a key cruise port—the council introduced a policy in 2024/25 to require working card terminals in licensed taxis at all times they’re available for hire, with the policy specifying card-payer traceability on bank statements (including badge/plate numbers). That gives cruise passengers consistency from the pier to hotels and rail stations. Other councils are consulting on similar rules (e.g., Swansea in June 2025), indicating the direction of travel nationwide.

What it means for PHV/minicab operators: While TfL’s specific “fixed device” requirement applies to hackney taxis, the expectation of card acceptance is now standard across PHV brands and dispatch platforms, and many councils list card acceptance among licensing conditions or best-practice guidance. Even industry advisories note that numerous areas already mandate card acceptance for licensed cabs.

Read Also – Is it easy to get a taxi at Luton Airport?

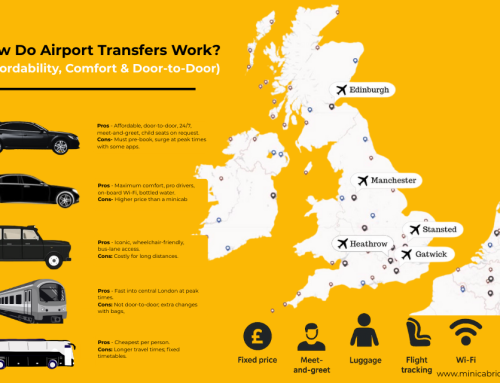

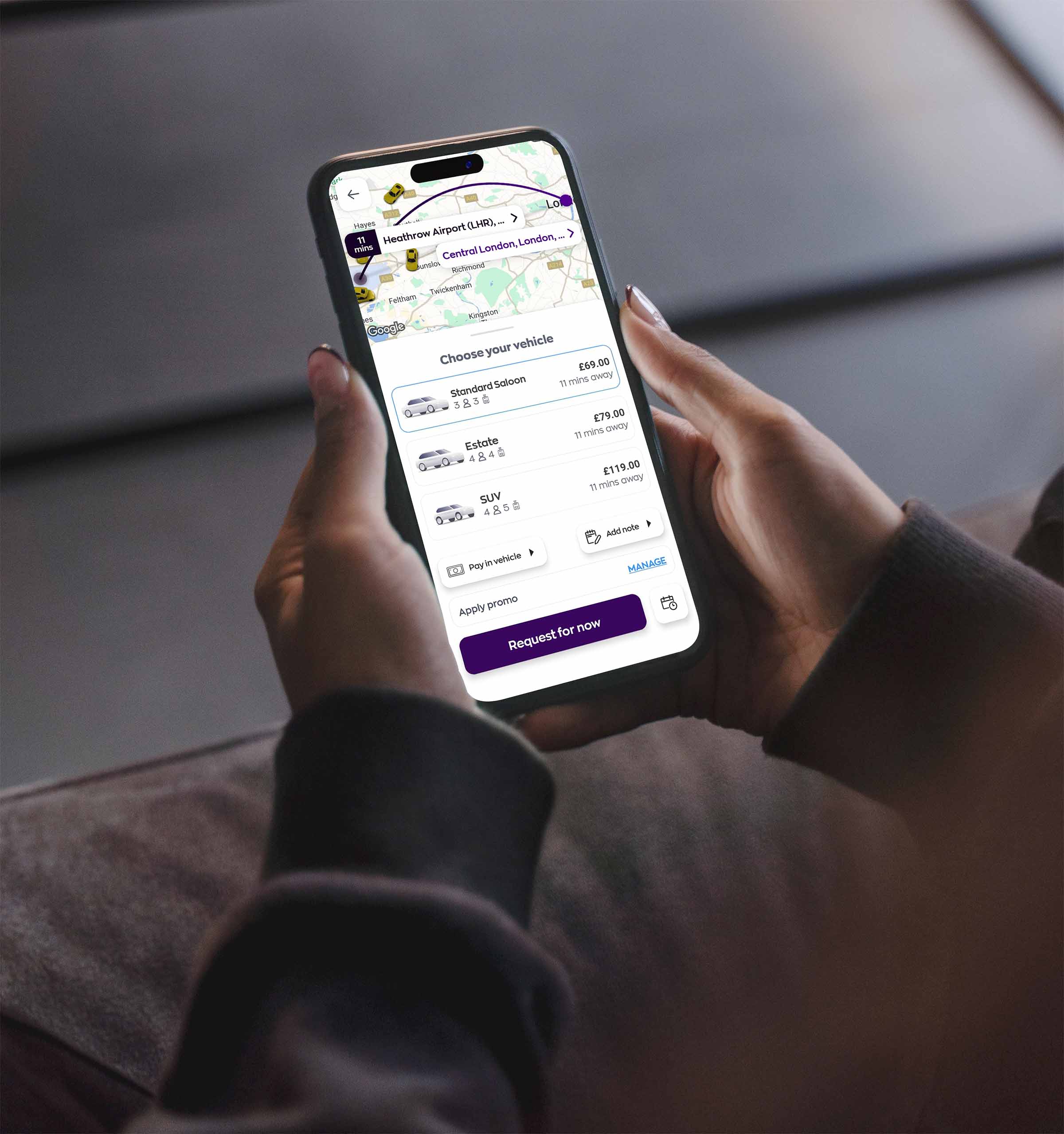

Airport transfers: what travellers will experience

Heathrow Airport :

- Black cabs at official Heathrow ranks are fully licensed, “Knowledge”-qualified, and accept card/contactless—no cash hunt needed after a long-haul flight. Expect a small Heathrow rank surcharge to be added to the metered fare; you will still pay by card at the end.

- Pre-booked Heathrow PHV/minicab transfers typically take payment in-app or via secure link before pick-up—again, cashless by design.

Gatwick Airport :

- Gatwick Airport Terminal drop-off charges are settled by card only, either online or at machines—there is no cash option—so cabs and PHVs naturally operate in a card-first environment.

Contactless pay-as-you-go rail is expanding across the South East (2025), making “tap-to-everywhere” journeys more common: tap onto Thameslink, tap into a minicab, tap at the hotel—same card or phone.

Other UK airports

- Luton, London City, Stansted, Manchester, Birmingham, Edinburgh, and others aren’t uniformly “card-only” by mandate for taxis, but passengers should expect card acceptance as standard from airport-approved operators and pre-booked PHVs.

Tip for travellers: For expense claims and reduced friction, ask your driver for an e-receipt at pickup (most systems can automatically email it at the end of the journey).

Read Also – Is it easy to get a taxi at Stansted Airport?

Cruise-port transfers: Southampton leads the way

Southampton is both the UK’s busiest cruise hub and a licensing bellwether. Its 2024/25 taxi policy updates require connected, working card terminals whenever a taxi is available for hire. That makes it much easier for cruise parties to pay for larger vehicles (people carriers/minibuses) without cash or awkward change—particularly on popular routes to major London airports or to city-centre hotels. Expect more port cities to follow with similar conditions or formal consultations.

City transfers: the frictionless default

For cross-town trips and intercity pre-bookings, card preference is baked in:

- Black cabs: London’s mandate ensures that every cab can accept tap-to-pay, with TfL now focusing on device reliability (including connectivity and accessibility) as part of its 2025 plan. That matters in signal-poor areas (tunnels, dense streets) where you still want the card reader to complete offline/online smoothly.

- App-based PHV: In-app card wallets—and increasingly corporate travel profiles—make city transfers fully cashless by default.

- Open-loop travel: Contactless pay-as-you-go on rail and Tube complements doorstep legs; “tap in, tap out” behaviour conditions users to expect the same at the taxi door.

Read Also – Is it easy to get a taxi at Birmingham Airport?

What about contactless limits and future flexibility?

The £100 contactless cap has been under active review, with the regulator exploring options to remove or adjust it. While any change must strike a balance between convenience and fraud protection, the conversation highlights the UK’s direction toward reducing friction at the point of sale—including in cabs. (As of mid-2025, the cap remains in place pending the FCA’s decision.)

Security, compliance, and chargebacks—driver and fleet perspective

Card-only cab operations work within a well-defined compliance stack:

- PCI DSS for device security and cardholder data.

- PSD2/SCA for authentication, with contactless and certain transport use-cases designed for speed while maintaining protection.

- GDPR for receipts and personal data handling (names, emails for e-receipts). Guidance aimed at UK merchants in 2025 emphasizes selecting devices and acquirers that simplify this process without slowing down the checkout process. For fleets, that means certified readers, reliable connectivity, and clear e-receipt workflows.

Fraud & disputes: In-person chip-and-PIN or contactless transactions generally shift liability appropriately and reduce counterfeit risk compared to cash acceptance. For PHV platforms, clear pre-auths and receipts reduce chargebacks on airport/city runs, where delays or route changes can lead to fare disputes.

Read Also – Is it easy to get a taxi at East Midlands Airport?

The business case: where card-only pays for itself

- Higher acceptance = higher conversion

Airport and cruise passengers include many international visitors who may not carry sterling; they accept Amex, digital wallets, and contactless boost ride conversion at ranks and meeting points. - Faster vehicle turns = more jobs per shift.

On constrained kerbs at Heathrow/Gatwick or around cruise terminals, every minute counts. Card-only removes cash counting, helps keep rank queues moving, and can directly increase shifts’ job counts. - Operational clarity for fees & surcharges

Airports increasingly use digital, card-only processes for drop-off/parking fees. Keeping everything on the card avoids drivers fronting cash or chasing reimbursements later. - Data for optimisation

Digital payments reveal clean data, including busiest routes/hours, average ticket sizes, and customer segments. That feeds pricing, driver scheduling, and even EV charging plans (aligned with other 2025 priorities).

Read Also – Is it easy to get a taxi at Manchester Airport?

Practical guidance (operators & drivers)

- Pick the right reader and plan for redundancy.

TfL’s 2025 plan highlights connectivity and accessibility; choose certified readers with roaming SIMs, offline fallback, and accessible placement for wheelchair users. Carry a spare if your fleet does heavy airport work where a down reader equals a lost fare. - Make receipts effortless.

Enable automatic e-receipts with journey details (useful for corporate travellers). For Southampton and some councils, ensure the bank statement descriptor includes the vehicle/driver/plate number as required. - Publish your card policy.

At cruise ports and hotels, clear signage—“Contactless & Cards Accepted. No Surcharge.”—reduces friction and improves queue flow. - Train for edge cases.

Know how to handle offline transactions, partial approvals, or switching to chip-and-PIN when required. Keep a laminated quick guide in the glovebox for new drivers.

Read Also – Is it easy to get a taxi at Glasgow Airport?

Practical guidance (travellers)

- Always carry two ways to tap: a physical card and a mobile wallet—roaming or battery issues happen.

- Ask for an e-receipt upfront if you’ll be expensing the trip; that nudges the driver to confirm the email address and phone number.

- Don’t worry about cash at Heathrow ranks: official black cabs accept card/contactless; a small rank surcharge applies and is clearly shown on receipts.

At Gatwick, expect card-only processes for terminal drop-offs. Use contactless rail if hopping to London before a cab—your same card/phone will work across modes. - From Southampton Cruise Port, licensed taxis are expected to have working card readers. Use them and request a receipt with the plate/badge number for your records.

Read Also – Is it easy to get a taxi at Cardiff Airport?

What could change next?

- Contactless cap decision

If the FCA modifies or removes the £100 limit, expect even fewer PIN prompts and faster flows for larger fares—applicable for longer city or airport transfers. - Tighter reliability standards

London’s stated push for minimum connectivity/accessibility standards for taxi card devices could ripple outward, with more councils copying the playbook for local fleets. - Deeper open-loop integration

As contactless pay-as-you-go spreads across National Rail, the “one tap to ride everything” mindset strengthens, keeping cash in the past.

Read Also – Is it easy to get a taxi at Edinburgh Airport?

Bottom line

The UK has crossed a tipping point: contactless payments are now the norm, and the taxi/PHV) sectors are standardising around card-only payments to match passenger behaviour and regulatory expectations. London’s decade-old mandate, Southampton’s 2024/25 rules, and the 2025 TfL action plan’s emphasis on reliable and accessible card readers all point in the same direction. For airport, cruise, and city transfers, card-only means shorter queues, smoother kerbside operations, clearer receipts, and fewer disputes—benefits for both passengers and operators.