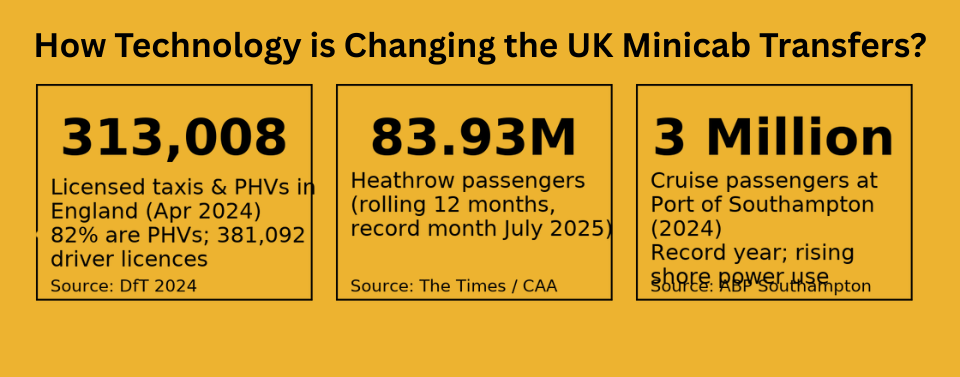

The UK’s taxi and private-hire market is significant—and getting bigger. As of 1 April 2024, England had 313,008 licensed taxis and PHVs, up 8.2% year-on-year; 82% of all licensed vehicles were PHVs, and driver licences hit 381,092 (+10%). That confirms the long-term shift from street-hail taxis to prebooked, app-driven private hire.

Demand on the ground is linked tightly to travel flows. Airports have rebounded strongly: Heathrow has posted record volumes, with 83.93 million passengers on a rolling 12-month basis and its busiest month ever in July 2025—prime territory for pre-booked airport transfers and meet-and-greet services.

Meanwhile, the UK’s top cruise gateway, Port of Southampton, handled ~3 million cruise passengers in 2024, another record, supercharging cruise turnaround day transfers to/from London and regional airports.

Against that backdrop, technology is quietly rewiring every part of the minicab journey: how riders book (smart apps and chatbots), how they’re kept informed (live tracking), how fleets dispatch (AI/automation), how companies integrate with travel, and how safety, accessibility, and sustainability are delivered.

Table of Contents

Toggle1) Smart booking apps: from “find me a car” to “manage my whole trip”

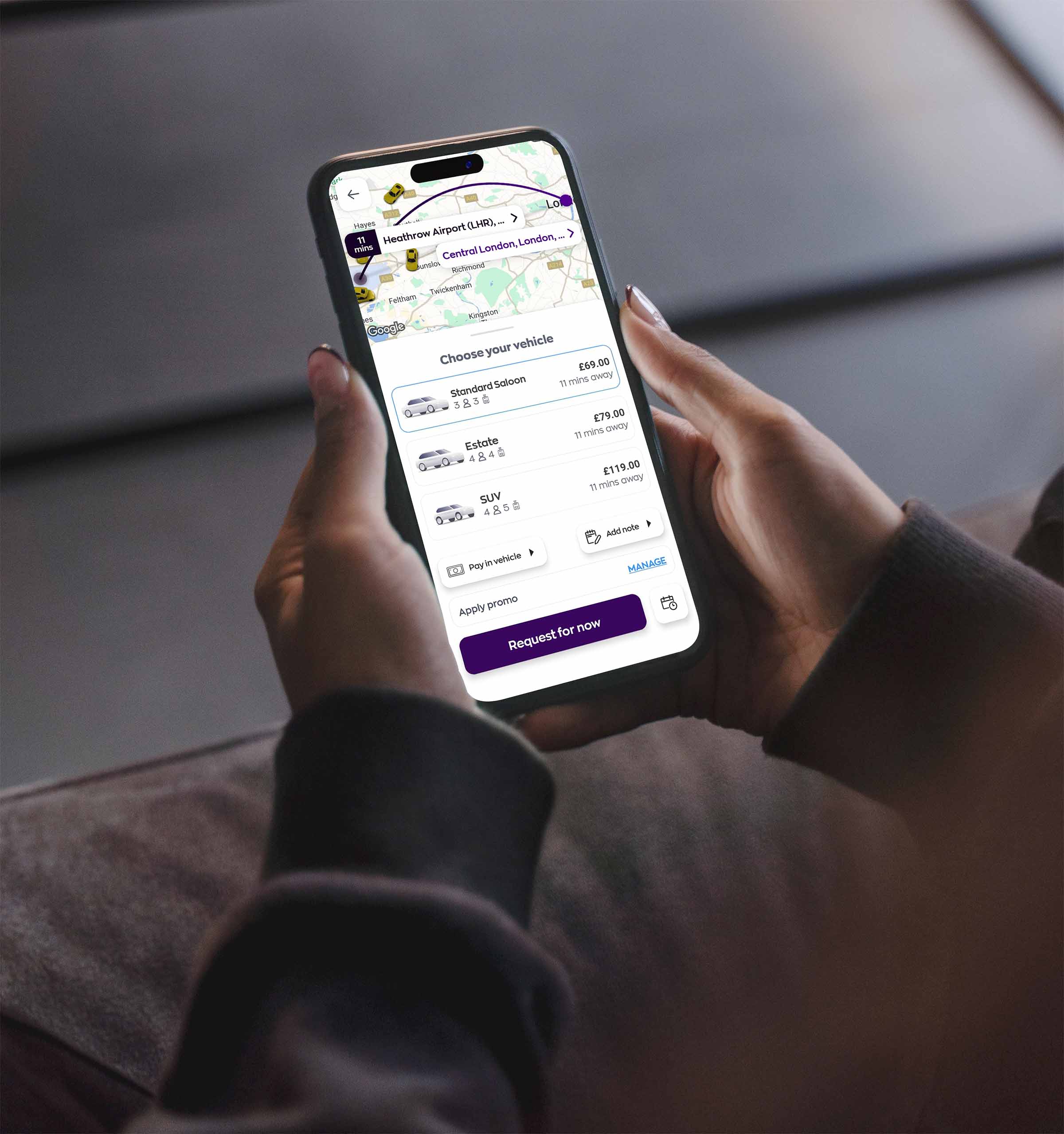

Modern UK apps do far more than hail a car. They quote fixed fares upfront, allowing bookings to be made days or months in advance, and offer surface vehicle classes (standard, MPV, executive, WAV). Additionally, they provide instant receipts and policy-compliant billing for business travel.

- Aggregators & multi-city reach. Services aggregate over 1,000 operators across more than 550 towns and cities, which is particularly useful when your origin/destination isn’t London. That breadth matters for airport runs from secondary hubs (e.g., Bristol, Manchester, Edinburgh) or cruise port day trips (e.g., Southampton ↔ London).

- Enterprise controls. Business platforms offer centralized booking, automated expense reporting, real-time tracking, and policy enforcement, which is critical when relocating staff to/from airports or conference venues at scale.

- Airport-specific features. Operators differentiate themselves with features such as flight tracking, free waiting time, meet-and-greet services, and SLA guarantees. For example, MiniCabRide offers “Airport Assured” transfers with a 100% on-time guarantee and flight monitoring—features that help reduce stress when arrivals are delayed.

Why does it matter for transfers?

For airport/cruise days, passengers prioritise certainty. Up-front fares (no surge), accurate ETAs, and pre-scheduled pickups—often with multiple pick-ups (family groups) or child seats—are now one tap away. Many dispatch systems even support multi-stop routing for split terminal pickups, automatically recalculating price and time.

2) Chatbots and WhatsApp booking: reducing friction at the front door

Not every rider wants to download another app. That’s where WhatsApp chatbots shine: customers can get quotes, book, edit, and receive updates right inside a familiar messenger.

- London Regional PHV brands, such as MiniCabRide, have deployed WhatsApp chatbots to automate quoting and bookings, utilizing the official API while demonstrating practical, working implementations.

- Several UK operators actively promote WhatsApp TaxiBots, allowing riders to “just message to book”—a handy feature for cruise passengers with limited roaming or spotty ship Wi-Fi.

- Specialist vendors offer AI assistants that handle the full booking flow 24/7, from quotes to confirmation, over WhatsApp.

Why does it matter for transfers?

On tight arrival windows, low-friction channels prevent drop-offs. A cruise guest can send a WhatsApp at breakfast to confirm a 09:00 pickup at the terminal and receive live driver details and tracking link without creating an account.

3) Real-time tracking and proactive comms: transparency as a service

Live tracking has evolved from a “nice to have” to a non-negotiable requirement. The best UK apps/platforms now provide continuous location sharing, two-way in-app chat, and one-tap “Share My Trip” safety features.

- Many Operators and others standardise live location, driver identity checks, and trip-sharing to trusted contacts. Uber introduced configurable Safety Preferences and Share My Trip flows to make these tools more visible, highlighting live location sharing and in-app chat as core safety UX.

- For corporate mobility, Business puts live journey oversight and analytics in one pane of glass—useful for travel managers running airport shuttles during events.

Why does it matter for transfers?

Real-time visibility reduces missed connections. If a flight lands early at Heathrow T5, dispatch can retime the pickup while the rider watches the driver approach in-app, avoiding curbside chaos and excess parking charges. For cruise turnarounds in Southampton, coordinators can track multiple vehicles to ensure all guests reach London hotels or airports on schedule.

4) Safety, verification, and duty of care: tech moves first

Safety expectations continue to rise—and technology is doing the heavy lifting.

- Features such as PIN/ride verification, emergency assistance, audio recording (where permitted), and identity verification of riders/drivers are steadily expanding across the ecosystem to counter fraud and reassure both parties in the marketplace.

- For business travel buyers, real-time tracking, verified drivers/vehicles, and regulated licensing rank as top selection criteria.

- In London, TfL’s 2025 Taxi & Private Hire Action Plan focuses on passenger experience, safety, accessibility, and environmental impact—signalling a continued regulatory push for high standards that technology can operationalize (training, knowledge refresh, digital communications).

Why does it matter for transfers?

Duty-of-care sensitive segments (unaccompanied teens, elderly travellers, VIPs, corporate execs) now expect trackable, verified rides with instant escalation options—especially for late-night airport pickups or long motorway transfers.

5) Payments, invoicing, and TMC integration: less admin, more accountability

The UK minicab stack has matured from card-in-car to fully automated payments with consolidated invoicing and policy controls:

- Up-front fixed fares (common on UK airport routes) eliminate anxiety over traffic or diversions and are compatible with corporate expense rules.

- Automated receipts and invoices, along with cost-centre coding, reduce administrative tasks for frequent flyers and travel managers. Business platforms expose analytics dashboards to track spend by traveller, route, or cost code.

Why does it matter for transfers?

On peak cruise disembarkation mornings or at terminals during bank-holiday surges, the ability to prepay/fix fares and auto-reconcile trips keeps queues short and finance teams happy.

6) Dispatch intelligence: auto-allocation, multi-stop, and surge smoothing

Behind the scenes, UK fleets have adopted modern dispatch platforms (Autocab, iCabbi, Cordic, INSOFTDEV, and others). These systems handle:

- Smart auto-dispatch to reduce dead miles and wait times

- Dynamic ETAs, load-balancing across zones, and driver scoring

- Multi-pickup and multi-drop routing (ideal for families or conference groups)

- Open APIs to integrate flight data, CRM, and WhatsApp bots

Why does it matter for transfers?

On a Saturday afternoon when two cruise ships dock and flights are delayed at LHR, intelligent dispatch keeps vehicles utilised, stops bunching, and ETAs realistic—preserving NPS.

7) Accessibility and inclusive service design

Technology also helps operators deliver accessible journeys at scale:

- Vehicle filtering allows riders to request wheelchair-accessible vehicles (WAVs) when available. In England, 54% of licensed taxis are wheelchair accessible, and all London taxis are; PHV WAV availability is lower (~2%), so prebooking via Web, apps, or chat is vital.

- In-app notes for assistance needs, driver training modules, and live chat reduce friction at pickup zones (e.g., meeting points at Heathrow T3 arrivals, or Southampton City Cruise Terminal).

8) Sustainability: EVs, shore power, and the connected charging ecosystem

London’s emissions rules and corporate ESG targets are accelerating the shift to hybrids/EVs in PHV fleets, supported by digital charging tools and route optimisation.

- Southampton reports a 50% increase in cruise vessels using shore power in 2024—signalling a greener ecosystem around cruise operations that EV fleets can complement.

- Partnerships between fleets and charging networks streamline driver charging/payments via app back-ends—key for keeping EVs productive on airport circuits.

Why does it matter for transfers?:

Airports and cruise terminals are setting sustainability expectations. Being able to request EV/low-emission vehicles, receive emissions reporting, and verify green credentials within apps is fast becoming a table stake for corporate and leisure travelers alike.

9) Airport transfers: what “great” looks like in 2025

Must-have features for UK airport runs:

- Flight tracking + dynamic pickup windows (avoid extra parking, reduce waiting)

- Meet-and-greet workflows with clear in-app meeting points (T2/T3 signage, pier numbers)

- Fixed pricing with grace periods for delays

- Multi-stop routing for families/teams arriving on different flights/terminals

- Live tracking + shareable links for duty of care

- Car class choice (estate/MPV for luggage, executive for VIPs)

- Receipts + policy-compliant billing (for TMCs)

- With Heathrow volumes at record highs, these features are the difference between a seamless handoff and a missed flight.

10) Cruise-port transfers (Southampton focus): the day-of-sailing pressure cooker

Turnaround days concentrate thousands of passengers into 5–7 hour windows. Winning operators use tech to:

- Batch and stage vehicles near terminals based on ship ETA and baggage hall status

- Broadcast pickup slots and WhatsApp confirmations the night before

- Deploy MPVs/minibuses with luggage capacity and share live tracking links for group coordinators

- Pre-assign drivers by hotel cluster (Waterloo/Victoria/Mayfair) to cut dead miles

With ~3 million passengers expected to transit through Southampton in 2024, scalable digital communications and dispatch are crucial to prevent terminal congestion and late arrivals in London.

11) City transfers: micro-optimisations at scale

For everyday city rides, technology quietly optimises the experience:

- Geofenced pickup logic for busy rail stations, stadia, and event venues.

- Roadworks/incident ingestion to reroute and maintain accurate ETAs.

- Chatbots to rebook or extend journeys mid-ride (e.g., add a stop to collect keys).

- Safety preferences (e.g., auto-sharing trips at night) that riders can set and forget.

12) What the data says about supply, demand, and direction

- Supply: England’s licensed fleet and driver base both grew in 2024; PHV share stands at ~82% of vehicles—evidence that prebooked, app-led journeys now dominate.

- Demand hubs: Heathrow’s record throughput and Southampton’s cruise volumes set a strong pipeline for transfer work in 2025–26.

- Enterprise adoption: Business platforms emphasise visibility, safety, and sustainability—all delivered digitally.

- Safety tech rollout: UK riders increasingly see verification, location sharing, and quick-access safety tools as standard.

13) How operators can win the next 12 months

Whether you’re an independent PHV operator, an airport specialist, or a cruise-turnaround partner, here’s a practical, tech-forward playbook:

- Meet your riders where they already are. Offer app + WhatsApp booking. The latter, especially, helps international travelers who rely on Wi-Fi/iMessage/WhatsApp instead of SMS.

- Over-communicate in real time. Live driver tracking, ETA updates, and shareable trip links cut anxiety and no-shows.

- Operationalise flight and ship data. Plug arrivals feeds into dispatch; automatically reschedule pickups and message riders when stands/pier assignments change.

- Engineer for groups and luggage. Surface MPV/estate options and multi-stop flows in the booking journey.

- Codify safety. Enable PIN verification, trip sharing, and emergency access by default; publish your safety playbook.

- Make accessibility easy. Let customers filter for WAVs, add assistance notes, and see guaranteed meet-and-assist steps in-app.

- Lean into EVs (and the data to prove it). Offer EV selection, publish grams CO₂ per km, and integrate with charging networks to keep utilisation up.

- Give finance teams what they want—up-front fares, consolidated invoices, and cost-centre tags.

14) What passengers should look for (a quick checklist)

- Fixed-price quotes (no surprises on motorway delays)

- Live tracking with shareable link

- In-app chat and clear meeting-point instructions

- Flight-tracking and automatic pickup adjustment

- Vehicle classes that match luggage/party size (estate/MPV/executive)

- Safety preferences and trip-sharing

- Accessibility options and notes where needed

- Easy receipts (and, for business, policy-compliant billing)

15) The road ahead: automation, AI, and more seamless multimodal trips

Expect incremental but meaningful gains:

- Smarter auto-dispatch (AI balancing of zones, dwell prediction at terminals).

- Rider identity verification is becoming normal to protect drivers and reduce fraud.

Deeper enterprise integrations (TMCs, meeting planners, airline IRROPS re-accommodation). - Greener journeys via routing + EV selection, in line with city policies and corporate ESG.

- Continued policy attention in London around driver attraction, passenger experience, safety, and accessibility—nudging the whole sector forward.

Infographic: Key numbers at a glance

- 313,008 licensed taxis & PHVs in England (Apr 2024); 82% PHVs; 381,092 licences.

- 83.93M Heathrow passengers (rolling 12 months; record month July 2025).

- ~3M cruise passengers at Port of Southampton in 2024; shore-power use up 50%.

Bottom line

Technology has transformed UK minicabs into a predictable, trackable, and bookable service from anywhere. For airport, cruise-port, and city transfers, the winners are the brands that meet riders in low-friction channels (apps + WhatsApp), proactively communicate with live tracking, hard-wire safety, and prove sustainability—all while nailing the basics: the right vehicle, at the right time, at a fair, fixed price.