Growing electric and hybrid vehicles aren’t just a consumer trend in 2025—they’re rapidly reshaping the UK’s taxi and private-hire market. From airport Transfers and cruise port transfers to everyday city rides, operators are switching to lower-emission fleets, aided by rapidly expanding public charging infrastructure, local licensing rules, and targeted partnerships at key travel hubs. Below is a deep dive into what’s changing, why it matters, and how greener fleets are delivering cleaner, quieter, and more efficient journeys.

Table of Contents

ToggleThe state of the fleet: hybrids lead, EVs accelerating

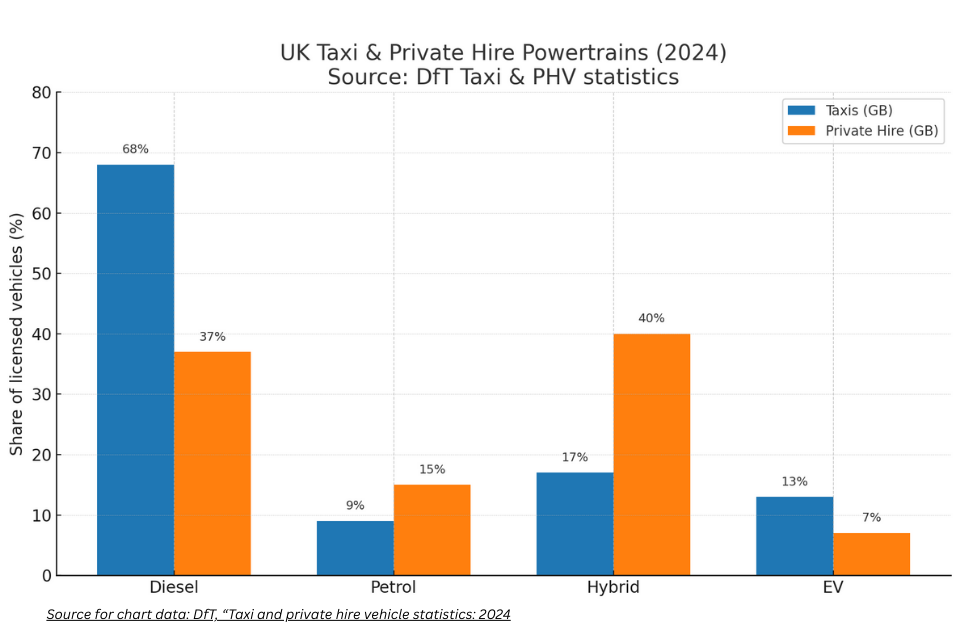

Department for Transport (DfT) figures show the rapid shift in the powertrain mix. Across Great Britain in 2024, hybrids already accounted for 40% of private-hire vehicles (PHVs) and 17% of taxis. Pure-electric vehicles (EVs) reached 7% of PHVs and 13% of taxis. Diesel—still dominant among hackney carriage taxis—has fallen to 37% of PHVs and 68% of taxis, with petrol now a minority fuel in both fleets. These shares set the baseline for 2025, with momentum clearly behind hybrid-electric and battery-electric drivetrains.

London remains a bellwether. Since 2018, every new taxi licensed in the capital must be zero-emission capable (ZEC), a rule that has steadily tilted the city’s black-cab fleet toward plug-in models. TfL’s 2025 Taxi & Private Hire Action Plan reiterates the system-wide push to “progress towards taxis and private hire vehicles becoming zero emission at the tailpipe.” Expect that to keep nudging the market—drivers and operators value vehicles that meet future-proofed standards and avoid clean-air charges.

Why 2025 is an inflection point: the charging network finally scales

Fleet electrification lives or dies on the availability of charging. Here, the news is positive: public charge points continue to rise at a rate of 25–35% year-on-year. Official DfT statistics (sourced from Zap-Map) report 73,334 devices nationwide as of January 1, 2025, rising to 76,507 by April 1, 2025; one in five devices is now 50 kW or higher (rapid or faster). Independent updates through H1 2025 put the total at ~82,000+ devices across ~40,000 locations, with ultra-rapid (150 kW+) units up ~23% in the first half of the year—exactly the speeds that private-hire and taxi drivers need for quick turnarounds.

Just as significant is hub growth—multi-bay rapid/ultra-rapid sites that handle peak demand. Q1 2025 added 49 hubs, bringing the total to 586, with the first half of 2025 expected to increase the UK’s total to ~673 hubs. For professional drivers, these hubs offer reliability, amenities, and multiple plugs that reduce queuing risk—a key operational advantage for airport and cruise port work, where timing is tight.

The airport transfer front line: Heathrow, Gatwick & beyond

Airports concentrate demand, so they’re natural proving grounds for Green Vehicles.

Heathrow has embedded EV infrastructure in its sustainability strategy (“Heathrow 2.0”), planning charging for passengers, colleagues, Heathrow airport taxis, and private-hire users as part of a wider net-zero pathway. A Civil Aviation Authority filing indicates that tens of millions of pounds are earmarked for scaling landside charging, with a projected annual carbon saving of 11,000 tonnes from the shift. Earlier investments included rapid chargers at the taxi feeder park to support electric black cabs and private electric car hire—helping drivers maintain rank availability while charging.

Gatwick has become a showcase for integrated EV charging. The GRIDSERVE Electric Forecourt at London Gatwick operates 24/7, offering contactless payments and support for a range of mixed connectors. In July 2025, GRIDSERVE and Addison Lee announced a partnership to provide Addison Lee drivers with on-site charging access, off-peak tariffs, and lounge facilities—explicitly designed to meet the needs of professional drivers and their Gatwick airport-transfer duty cycles. This reduces dead time, stabilises charging costs, and makes EVs more attractive for premium transfer work.

Regional airports are following suit. Southampton Airport, for instance, has APCOA/Compleo chargers in the multi-storey; while aimed at passengers, their presence signals the normalisation of EV support at smaller hubs—useful for local Southampton Airport private-hire operators consolidating airport runs.

What does it mean for passengers?

- Cleaner kerbside experience: EVs cut local NOx and particulate emissions—especially valuable in congested terminal approaches—and reduce noise at pick-up points. TfL policies, CAZ/ULEZ frameworks, and airport strategies are aligned to capture these benefits.

- Greater reliability: Hub-style charging near airports reduces the risk that your driver needs a long detour to power up. Gatwick’s forecourt model—with multiple bays and extended opening hours—shows how infrastructure can be tailored to high-utilisation fleets.

- Transparent pricing over time: As more professional driver partnerships negotiate driver-friendly tariffs, EV operating costs become more predictable, which helps operators offer stable, fixed-price transfers even during volatile fuel markets.

Cruise-port transfers: Southampton & Portsmouth turn the tide

Cruise volumes rebounded strongly in 2023–25, and port cities are using the recovery to lock in low-emission ground transport.

Southampton, the UK’s busiest cruise port, has added EV charge points at cruise-terminal car parks and around the city. The council has also installed rapid charging facilities specifically for Southampton cruise port taxi/PHV use, signaling support for electrifying high-mileage vehicles serving cruise passengers. For operators, the mix of terminal-adjacent AC charging and city rapid units makes it viable to schedule quick top-ups between drop-offs and collections.

Portsmouth International Port is aiming to achieve zero-emission port status by 2050 and net-zero operations by 2030. While shore-power and hybrid ferries sit outside taxi operations, the same program is rolling out EV charging, cleaner air policies, and a citywide Clean Air Zone (CAZ) that charges non-compliant taxis and PHVs £10/day. For Portsmouth Port private-hire firms offering cruise transfers into central Portsmouth, operating hybrid/EV vehicles reduces both emissions and CAZ costs, thereby protecting margins on fixed-price cruise work.

City transfers: clean-air rules are shaping fleets

Local policy is a powerful catalyst. London’s ZEC rule for newly licensed taxis, and TfL’s ongoing environmental enforcement, push the market toward plug-in models. Other cities are using Clean Air Zones (e.g., Portsmouth B-class CAZ) that levy daily charges on non-compliant taxis/PHVs. Hybrids and EVs avoid or minimise these penalties, which is one reason hybrid share is already dominant in the PHV segment nationally.

Charging access is improving alongside these rules: the national leap from ~73,000 public chargers in January to ~76,500 in April—and to ~82,000 by mid-year—means fewer “charging deserts.” Crucially, higher-powered (50 kW+) devices now account for ~20% of public infrastructure, speeding up turnarounds for professional drivers.

Economics: TCO is tipping for high-mileage duty cycles

For airport/cruise/city work, utilisation is king. EVs often win on total cost of ownership (TCO) in high-mileage scenarios thanks to:

- Lower energy costs per mile compared to petrol/diesel, especially with access to off-peak tariffs or negotiated rates at hubs (e.g., the Gatwick partnership).

- Reduced maintenance (fewer moving parts, regenerative braking).

- Policy savings (ULEZ/CAZ exemptions, ZEC compliance).

The most significant operator-side risks—charger reliability, queues, and pricing opacity—are easing as hubs multiply and airports/ports prioritise on-site or near-site facilities. Still, reliability varies by network, and industry voices continue to push for better uptime standards and clearer public-charging VAT parity with home electricity.

What operators are doing in 2025

- Hybrid as a bridge, EV as the goal. Many private Hire firms are integrating Electric and Hybrid vehicles in our fleet group. Many PHV fleets are hybrid-heavy today (40% share), but new orders are increasingly battery-electric, especially for larger MPV/SUV formats serving families and cruise passengers with luggage.

- Airport-aligned charging strategies. Partnerships like Addison Lee × GRIDSERVE (Gatwick) and Heathrow’s land-side EV focus demonstrate the template: place rapid/ultra-rapid charging where drivers wait and dwell, and integrate rest amenities to make charging time productive.

- Licensing roadmaps. City licensing conditions (ZEC, age limits, Euro standards) inform procurement cycles. Operators increasingly model vehicle lifecycles around these rules to avoid mid-term compliance shocks.

- Data-led dispatch. Electrified fleets benefit from dispatch tools that route drivers based on hub availability, price signals, and state of charge, thereby reducing dead miles and minimizing queuing. (Industry trend; supported by the growth of charge-point data and hub density.)

Segment deep-dives

Airport transfers –

- Vehicle choice: Quiet EV saloons and MPVs (with heat pumps and larger batteries) now cover most Heathrow/Gatwick transfers on a single charge, with a rapid top-up between jobs when needed.

- Charging logistics: Gatwick’s Electric Forecourt® and partner access for professional drivers reduce “range anxiety” on back-to-back jobs, while Heathrow’s EV investments aim to support both taxis and PHVs at scale.

- Passenger experience: Lower cabin noise at pickup, real-time flight tracking + fixed pricing, and (in many cases) preferential kerbside access for licensed operators help create a smoother experience.

Cruise-port transfers –

- Demand profile: Peaks around sailing windows and luggage-heavy groups favour larger EVs/plug-in vans with high boot volumes.

- On-the-day charging: Southampton’s terminal-adjacent AC points and city rapid taxi chargers let drivers opportunistically top up between drop-offs and collections—Portsmouth’s CAZ nudges fleets toward compliant hybrids/EVs to avoid fees.

- Sustainability halo: Ports publicise decarbonisation—from shore-power projects to hybrid ferries—and prefer landside partners aligned with that message. Operators highlight EV fleets in cruise-line ground-transport bids.

City transfers

- Stop-start efficiency: Hybrids remain strong for dense urban trips, but EVs shine on TCO when rapid hubs are nearby.

- Compliance: ZEC/ULEZ/CAZ frameworks favour zero-tailpipe fleets; operators win corporate accounts by offering emissions accounting and green travel reporting.

Challenges to watch

- Upfront cost and grants: Press coverage suggests concern about the Plug-in Taxi Grant’s trajectory; any reduction pressures driver affordability. Industry groups argue targeted support remains necessary while EV upfront prices stay elevated.

- Home/on-street charging inequity: Many drivers lack off-street parking. National and local schemes are still working through practical and safety hurdles for cross-pavement charging solutions—a barrier to low-cost overnight charging for some.

- Motorway charging policy shifts: The government’s approach to funding rapid charging for motorways remains in flux; the current emphasis is tilting toward general and on-street infrastructure, which may be less suitable for long-haul taxi work between cities.

Practical roadmap for operators in 2025

- Run the numbers by duty cycle. For airport/cruise heavy use (150–250+ miles/day), model EVs with hub-based top-ups; for purely urban work, compare EV vs. hybrid TCO including CAZ savings. Use the April 2025 charging baseline to validate local availability.

- Anchor charging where you dwell. Prioritize airport- or port-adjacent hubs, depot fast chargers, and preferential tariffs. Consider partnerships akin to Addison Lee × GRIDSERVE to stabilise energy costs.

- Choose platform-friendly EVs. – Eco-friendly way to travel from the airport to the city. Look for models with >250-mile WLTP, 11 kW AC, and >120 kW DC capability, large boots, and efficient HVAC; they’re better suited to winter airport runs and luggage-heavy cruise jobs.

- License to the future. Procure with ZEC/CAZ timelines in mind to avoid stranded assets.

- Tell the sustainability story. – Rise of sustainable travel, Corporate clients and travel brands are increasingly requesting emissions reporting. Build trip-level CO₂ estimates into invoices and RFP responses.

The bottom line

There are numerous benefits of travelling with electric and hybrid vehicles. The UK’s taxi and private-hire market is past the “early-adopter” phase. Hybrid fleets currently dominate PHV, and EV adoption is rising rapidly in response to stronger charging networks, airport/port partnerships, and licensing policies that reward zero-tailpipe vehicles. For airport, cruise port, and city transfers, these changes deliver quieter rides, cleaner air at the curb, and—crucially—better economics for high-mileage operators. In 2025, going green isn’t just good PR; it’s becoming the rational business choice.