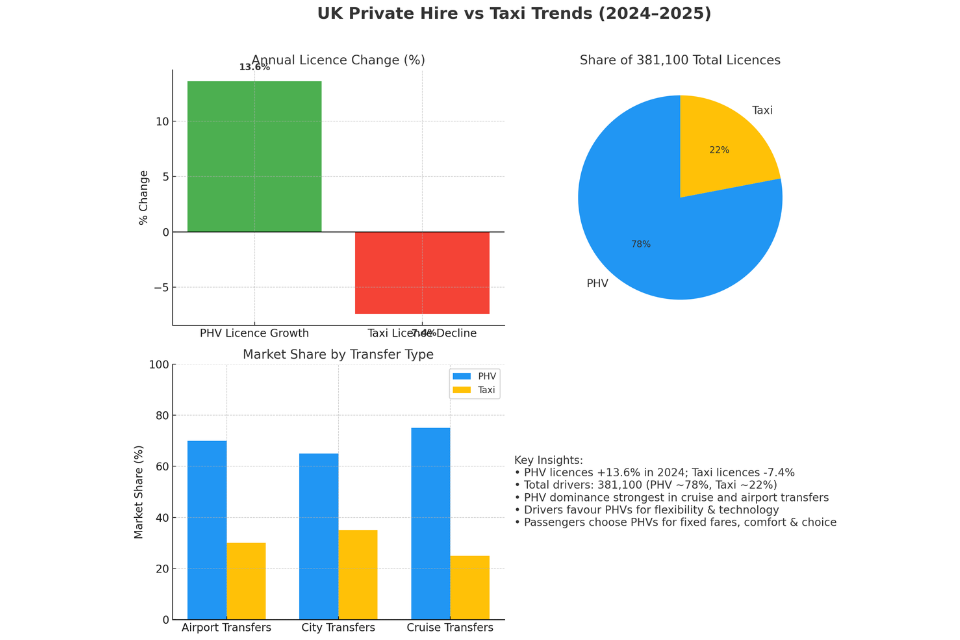

The UK’s ground transportation sector is undergoing one of its most significant shifts in decades. As of April 2024, the country had recorded 381,100 combined taxi and private hire vehicle (PHV) driver licenses, marking a 10% year-on-year increase and exceeding pre-pandemic numbers by approximately 20,000. However, beneath this headline growth lies a stark contrast: PHV licences surged by 13.6%, while traditional taxi licences fell by 7.4%.

This divergence signals a profound change in how Britons — and millions of international visitors — are choosing to travel, especially for airport transfers, local city journeys, and cruise port connections. Let’s explore the reasons behind the boom in private hire and the gradual decline of traditional taxis, and what it means for passengers, drivers, and the wider industry.

1. Understanding the Shift: Why PHV Is Growing and Taxis Are Shrinking

a) Flexibility and Technology

Private hire vehicles — whether booked via major ride-hailing apps, local minicab firms, or executive chauffeur companies — have capitalised on the digital booking revolution. Passengers can book in seconds, track their driver in real time, and pay seamlessly via card or app.

Traditional taxis, while iconic (especially London’s black cabs), have been slower to adopt such convenience at scale, often relying on street hails or phone bookings.

b) Cost Efficiency

In many UK cities, PHVs can undercut taxi fares, particularly on long-distance airport or cruise transfers where fixed-price booking models are standard. Taxis, with metered fares, can sometimes be perceived as less predictable in cost, especially in heavy traffic.

c) Regulation and Licensing Differences

Taxi licensing is often more restrictive — for example, London black cab drivers must pass the famously difficult “Knowledge” test, which can take years to complete. PHV drivers, while still vetted, have a faster route to licensing, attracting new entrants and enabling rapid growth in fleet numbers.

d) Vehicle Choice and Comfort

PHV operators often offer newer, more varied vehicles, including hybrids and electric models, executive saloons, and multi-seater MPVs. This makes them appealing for group transfers or travellers with large amounts of luggage.

2. Impact on Airport Transfers

Airports are a vital battleground for both taxis and PHVs, as they represent high-value, high-frequency journeys. In the UK, major hubs such as Heathrow, Gatwick, Luton, Manchester, Birmingham, and Stansted Airport process tens of millions of passengers annually.

a) PHV Advantages

- Pre-booking Guarantees – PHV operators can confirm a pick-up time, track flight arrivals, and adjust schedules accordingly, offering a personalised “meet and greet” service.

- Fixed Fares – Passengers know precisely what they will pay before the journey begins, avoiding any surprises due to airport traffic congestion.

- Vehicle Variety – For business travelers, executive PHVs (such as Mercedes-Benz E-Class and BMW 5 Series) offer comfort and prestige. Families can opt for larger MPVs to accommodate multiple suitcases and pushchairs.

b) Challenges for Traditional Taxis

While taxi ranks remain outside all major UK airports, they face competition from PHV drivers who wait off-site and arrive upon passenger booking. Moreover, airport surcharges and longer waiting times in queues can deter price-sensitive passengers.

c) The Sustainability Edge

PHV companies are investing heavily in electric and hybrid vehicles to comply with airport environmental initiatives, giving them an advantage over older diesel taxis that face additional charges in low-emission zones.

3. Local City Transfers: The Everyday Shift

The growth of PHV licences isn’t just about airport travel — it’s also reshaping daily city transportation.

a) Why Urban Travellers Choose PHVs

- Door-to-door service without having to locate a taxi rank.

- In-app loyalty schemes and promotional discounts.

- Choice of service tiers (budget, standard, executive).

- Transparent ETA and pricing, reducing the anxiety of unpredictable fares.

For example, in Manchester, PHV bookings now dominate evening leisure travel, particularly among younger riders who value the ability to share fares via app-split payment features. In Birmingham, corporate accounts with PHV firms allow businesses to track staff journeys for expense management and duty-of-care compliance.

b) The Taxi Counterpoint

Traditional taxis still hold an edge in some high-density city centres where bus lanes and taxi-only access roads give them faster journey times. London’s black cabs, for example, can bypass specific congested routes that PHVs cannot use. However, as congestion charging zones expand and more streets become pedestrian-only, the advantage is narrowing.

4. Cruise Transfers: A Growing PHV Niche

UK cruise terminals — notably Southampton Cruise Port, Portsmouth Cruise Port, Dover, Liverpool, and Tilbury — have experienced a rise in passenger volumes since the pandemic. Cruise travellers, often carrying multiple pieces of luggage and arriving in groups, are increasingly booking PHVs for their door-to-port transfers.

a) PHV Strengths for Cruise Travel

- Pre-planned logistics – PHVs can time arrivals precisely to match ship boarding slots.

- Luggage capacity – Operators offer 7-seater MPVs or minibuses, ideal for families or group travellers.

- Direct routes – PHVs can provide fixed-fare services from inland cities straight to the cruise terminal, bypassing the need for train connections.

b) Taxis in the Cruise Market

While taxis are present at ports, they often rely on ad-hoc passengers disembarking without pre-arranged transport. PHVs, on the other hand, capture business before travellers even arrive in the UK, with online booking systems targeted at international tourists.

5. Regional Variations in the Shift

The PHV surge and taxi decline are not uniform across the UK.

- London – Still home to the most famous taxi fleet in the world, but PHV operators like Uber, Bolt, Addison Lee, and MiniCabRide dominate app-based bookings. High licensing costs and the Knowledge test continue to deter new taxi drivers.

- Scotland – Cities like Edinburgh and Glasgow have strong PHV growth, but also organised taxi industry protests over market saturation.

- Northern Ireland – More balanced, with taxis still holding cultural and practical value, though PHV growth is accelerating.

- South Coast Ports – Cruise-driven demand fuels popularity of PHVs, especially in Southampton.

6. Economic and Regulatory Factors Driving Change

a) Earnings and Job Viability

A 2024 national survey found that over 40% of taxi and PHV drivers feel the job is “no longer worthwhile,” citing low earnings, long hours, and regulatory pressures. However, PHV drivers often have more flexibility in choosing work hours and types of journeys.

b) VAT and the “Taxi Tax” Debate

A looming VAT liability threatened to raise fares for PHVs by 20%, but a July 2025 UK Supreme Court ruling exempted most operators outside London from the charge. This decision is likely to accelerate PHV growth even further.

c) Environmental Regulation

Cities are pushing low-emission or zero-emission requirements, incentivising PHV firms to upgrade fleets rapidly. Taxis, with more stringent vehicle specs, face higher replacement costs.

7. Passenger Experience: The Deciding Factor

In 2025, passenger expectations are higher than ever:

- Real-time tracking of drivers.

- Digital receipts for expenses.

- Multi-language support for international travellers.

- Child seat options for families.

- Disability-friendly vehicles and trained drivers.

PHV companies have been quicker to adapt to these demands, integrating AI-powered route optimization and personalization features. Traditional taxis, although improving, face structural challenges in keeping up with this pace.

8. The Future Outlook

If current trends continue:

- PHV licences are expected to surpass 300,000 active drivers nationwide within three years.

- Taxi numbers will continue to decline unless there is significant industry reform and investment.

- Airport, cruise, and intercity transfers will become the main battlegrounds for customer loyalty.

- Autonomous vehicles, already trialled in parts of the UK, could disrupt both models within a decade.

9. Key Takeaways for Passengers

- For airport transfers, Private hire companies offer pre-booking, fixed prices, and a choice of vehicle sizes, making them ideal for international arrivals and groups. Taxis offer immediacy if you prefer to walk out and get in a cab.

- For local city travel, PHVs offer booking convenience and loyalty rewards; however, taxis still have the edge in specific traffic-restricted routes.

- For cruise port transfers, PHVs dominate in terms of capacity, pre-arranged service, and online booking from abroad; taxis remain an option for last-minute travel.

Final Thoughts :

The UK’s transport sector is undergoing a generational shift. The statistics are clear — private hire is growing fast, traditional taxis are shrinking. The reasons are rooted in technology, economics, regulation, and changing passenger expectations.

For airport travellers, city commuters, and cruise passengers, the rise of PHVs means more choice, more transparency, and often better value. For the taxi industry, it’s a call to adapt or risk further decline.

In the years ahead, both models will need to coexist — each serving different needs — but the momentum is unmistakably with the private hire sector.